How to Improve Your Credit Score to Obtain Finance

Are you looking to obtain finance? Then you need a good credit score. Below I will outline ways how to improve your credit score.

Your credit score will determine whether you are eligible for finance or how much you may be entitled to borrow.

In this article, we will focus on how to improve your credit score to obtain a mortgage. It is good to note that the principles are the same when you are looking to apply for other types of finance including, loans, HP or credit cards.

When securing a mortgage, your credit score plays a crucial role.

A higher credit score can increase your chances of a mortgage approval and help you secure better terms and interest rate.

What’s my credit score?

You may be asking, well I don’t even know my credit score. How do I find out what my score is?

It’s easy, there are three leading providers of credit score companies in New Zealand.

Centrix https://www.centrix.co.nz/my-credit-score/

Equifax https://www.mycreditfile.co.nz/

Illion https://www.creditcheck.illion.co.nz/

You can apply for a free credit score report within minutes and if you want to go a bit further you can also join on a yearly membership giving you extra benefits all year round.

Before discussing ways to improve your credit score, let’s look at what a credit score represents and looks like.

Your credit score

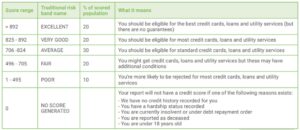

Below is a table that represents a credit score (supplied by Centrix).

Credit scores range from 1 to 1000, with 1 being the lowest and 1000 being the highest credit score possible.

As you can see depending on your score depends on your risk, low scores rate high risk, and high scores rate low risk or excellent as Centrix calls it. (Source Centrix).

How to Improve Your Credit Score to Obtain Finance

Review your credit report:

The first step in improving your credit score is to obtain a copy of your credit report from the credit agencies as discussed above. Carefully review the report for any errors, such as incorrect personal information or inaccurately reported debts.

Dispute any discrepancies and have them corrected promptly, as these errors can negatively impact your credit score now and in the long run.

Pay bills on time:

Consistently paying your bills on time is one of the most critical factors influencing your credit score. Late payments can significantly harm your score, so make it a priority to pay all your bills by their due dates. Set up automatic payments or create reminders to help you stay on track.

Reduce credit utilisation:

Credit utilisation refers to the percentage of available credit you are currently using. Lower credit utilisation ratios typically indicate responsible credit management. Paying down existing debts and avoiding maxing out credit cards can help reduce your credit utilisation ratio.

Manage debt responsibly:

Demonstrating responsible debt management is essential for improving your credit score. Avoid taking on excessive debt and focus on paying down existing debts. Consider creating a debt repayment plan that prioritizes higher-interest debts first while making minimum payments on others.

Maintain a healthy credit mix:

Lenders prefer to see a diverse mix of credit types on your report, including credit cards, loans, and mortgages. A well-rounded credit profile demonstrates your ability to handle different types of credit responsibly. However, be cautious not to open multiple accounts within a short period, as it can negatively impact your credit score.

Lengthen your credit history:

The length of your credit history also affects your credit score. If you have a short credit history, it can be beneficial to maintain older credit accounts, even if they have a low or zero balance. These accounts contribute to the length of your credit history, showcasing your experience in managing credit responsibly.

Avoid opening unnecessary credit accounts:

While it’s important to have a healthy credit mix, avoid the temptation to open new credit accounts unnecessarily. Each time you apply for credit, it triggers a hard inquiry on your credit report, which can temporarily lower your score. Only open new accounts when necessary and after careful consideration.

Regularly monitor your credit:

Keep a close eye on your credit report and monitor it regularly. Look for any errors, fraudulent activity, or discrepancies that could impact your credit score.

Work with a financial advisor:

If you’re struggling to manage your debts or improve your credit on your own, consider seeking assistance from a reputable financial advisor. They can provide guidance, create a personalised plan, and help you reach your money goals.

Where do they get your credit score information from?

Credit agencies collect personal information, financial data, and other information on you from a variety of sources.

This includes banks, finance companies, telcos, power companies, and debt collection agencies.

Other sources of information can come from the Companies Office, Personal Property Securities Register (PPSR), and the Government’s driver’s licence database.

What if I think my credit score is wrong?

If you think any information on your credit score is incorrect, you can request to correct it by contacting the credit agency.

They will then contact the organisation that provided the information.

How long does this information stay on my credit file?

Credit agencies can hold your information for up to 5 years.

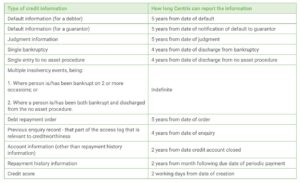

In the table below you can see how long Centrix can report your information.

After 1 year some of your credit history may not be seen via your credit score however, credit agencies may still hold information on you, but not report the information to you directly. (Source: Centrix)

How to improve your credit score, final note:

Improving your credit score is a journey that requires discipline and perseverance, but the rewards are well worth it, especially when it comes to securing a better mortgage.

By reviewing your credit report, paying bills on time, reducing credit utilisation, managing debt responsibly, diversifying your credit mix, and lengthening your credit history, you can unlock the power of credit and position yourself for a more favourable mortgage offer.

Remember, small steps today can lead to significant benefits in the future.

Start building your creditworthiness today and watch as your dream of homeownership becomes a reality.

I hope the above has given you an idea on how to improve your credit score, however, please contact us if you would like further help.

David Windler

Financial Adviser and Mortgage Broker

Director The Mortgage Supply Company